Financial Process Automation: A Huge Untapped Source of Potential Cost Reduction

Automation | Accounting and Finance

This is the second of three posts on the theme -- CFOs and Finance Directors: Neglected Players in the Drive for Digital Transformation. The first post was here.

The core point of the three posts is the financial process automation creates a value stream in two directions. It is a proven source of cost reduction for companies looking for marginal but sustaining competitive advantage, something that Finance Directors can use to "manage up" in their organizations in making a case for resources to drive financial process automation, which is the focus of this post. Financial process automation also creates the foundation for sound analytics and business intelligence, a priority of great concern to the C-Suite, which will be the focus of the third post.

The American Productivity and Quality Center notes that cost reduction is the key business driver for 43% of financial improvement initiatives. Let's think about the role that content and more effective management of unstructured information plays in delivering upon this promise.

The Harvard Business Review notes the importance of permanent process change in the drive to cut costs and automating the capture component of processes is a key part of ensuring the permanence of change.

“Often, internal administrative processes become frozen—despite the fact that, over time, they may cease to be efficient or effective. Asking questions in four areas can help you understand whether this has occurred in your department and whether you can cut expenses accordingly:

Reduced business requirements. How have the business requirements evolved since you last fundamentally redesigned the process? Perhaps the need for certain data has diminished or disappeared altogether. How would you design the process differently today, to meet today’s needs?

Manual processes. Where do you use people to process forms or information repetitively, rather than do it electronically, with little or no human intervention?

Exceptions to the norm. Do the routine 90% of items cost much less to handle than the exceptional 10%? What would it take to do away with the exceptional ones? At a large health insurer, we found that a 'clean' claim cost 80% less to process than one that required special handling. By redesigning its claim forms and eliminating exceptions that did not matter, the client saved more than half the cost of exceptions.

Timing. Could you save money by shifting the time of day, week, or month that you undertake certain tasks? For example, how about doing the work when activity in your department is otherwise slow? Could it be done more efficiently in batches? Is there a real penalty attached to being available online for fewer hours of the day? Could tasks be completed more efficiently if they were not tackled on a first-in, first-out basis?”

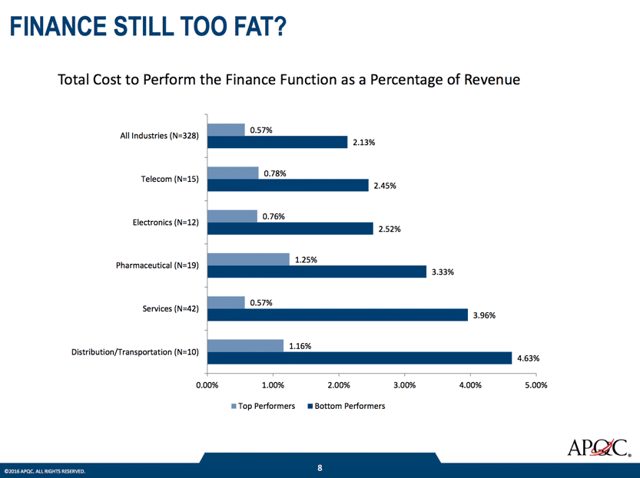

Financial processes have three key characteristics that make them a prime candidate for cost reduction efforts: 1) They represent a significant cost to the organization; 2) They are characterized by wide variation in performance, and 3) They are typically very paper-intensive.

Consider this data from the American Productivity and Quality Center. And consider what this means in actual dollars:

Let’s break this down a bit. There are five core processes characteristic of just about any finance department:

- Accounts Payable

- Accounts Receivable

- Financial Close Process

- Procurement & Purchasing

- Vendor Management

What do these have in common? They are all: 1) document-intensive; and 2) must integrate with your broader financial and/or ERP (Enterprise Resource Planning Systems). Your ability to automate them and reduce cost – your key to moving from a bottom performing finance organization to a top performing one – rests on putting in place a common document management infrastructure for all of them.

|

Financial process |

Document challenges |

|

Accounts payable |

Automation cannot occur without a strategy to capture documents that arrive from multiple locations and in widely varying formats |

|

Accounts receivable |

Disconnected and manual contracts, billing, sales order, and dispute resolution processes |

|

Financial close process |

Endless, frantic and manual end-of-month spreadsheet reconciliation |

|

Procurement and purchasing |

Manual purchase order processes disconnected with finance and ERP systems |

|

Vendor management |

Manual vendor onboarding No central view of relationships with key business partners |

Most organizations have not applied the lessons from the digital mailroom to their core financial processes. According to an AIIM unreleased survey of 290 finance executives, there are still many green field transformation opportunities in your core financial processes. Some would argue that most organizations automated their financial processes long ago. Perhaps on the data side, but not on the content and unstructured information side. When we asked, “What is paper usage in the following processes?” here are the percentages answering, “% answering “A lot of documents are processed as paper documents”:

- Accounts receivable = 38%

- Financial close process = 40%

- Accounts payable = 39%

- Procurement and purchasing = 32%

- Vendor management = 32%

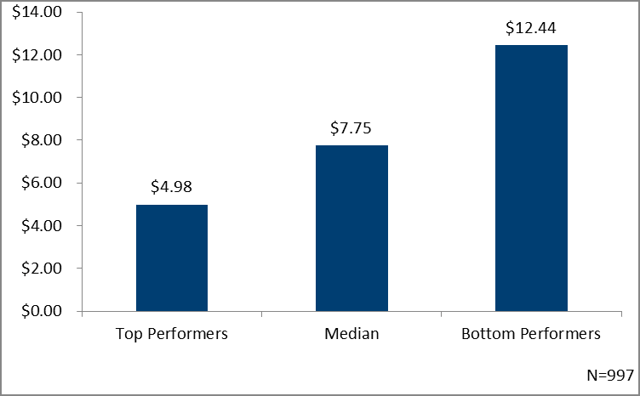

Consider the differences in cost structure associated with invoice processing in top performing vs. bottom performing companies:

Information Capture is a proven first step in digitizing information and improving financial processes. According to AIIM’s Paperfree Progress: Measuring Outcomes, 72% agree – “Business at the speed of paper will be unacceptable in a few years’ time.”

Financial process automation has been one of the bread and butter content management applications for years. But I think these initiatives need to be viewed not only through the prism of cost reduction, but also in terms of how back-end process automation and efficiency are now Digital Transformation table stakes. In a world in which customers and suppliers are being drawn further and further into our organizations, no smooth and beautiful front end customer experience can compensate for weak supporting processes that are inevitably the next step in customer experience. Finance Directors need to understand this critical linkage and use it to "manage up" in their organizations in making a case for resources to drive financial process automation.

About John Mancini

John Mancini is the President of Content Results, LLC and the Past President of AIIM. He is a well-known author, speaker, and advisor on information management, digital transformation and intelligent automation. John is a frequent keynote speaker and author of more than 30 eBooks on a variety of topics. He can be found on Twitter, LinkedIn and Facebook as jmancini77. Recent keynote topics include: The Stairway to Digital Transformation Navigating Disruptive Waters — 4 Things You Need to Know to Build Your Digital Transformation Strategy Getting Ahead of the Digital Transformation Curve Viewing Information Management Through a New Lens Digital Disruption: 6 Strategies to Avoid Being “Blockbustered” Specialties: Keynote speaker and writer on AI, RPA, intelligent Information Management, Intelligent Automation and Digital Transformation. Consensus-building with Boards to create strategic focus, action, and accountability. Extensive public speaking and public relations work Conversant and experienced in major technology issues and trends. Expert on inbound and content marketing, particularly in an association environment and on the Hubspot platform. John is a Phi Beta Kappa graduate of the College of William and Mary, and holds an M.A. in Public Policy from the Woodrow Wilson School at Princeton University.